Frankfurt, January 30, 2025. With the abolition of the so-called ancillary cost privilege on July 1, 2024, which prohibits the billing of cable TV fees through ancillary costs, the level of awareness among affected households has significantly increased. The second wave of the AGF Platform Study 2024 (2024-II), conducted by AGF Videoforschung in collaboration with Kantar from August 5 to September 26, 2024, and the results now available, shows that the majority of affected households have actively taken measures to ensure their TV reception.

According to the study, 92.6 percent of the affected rental households are now informed about the abolition—a remarkable increase compared to the spring 2024 survey wave, where only 53.4 percent of households had heard about the changes.

The majority of households take action

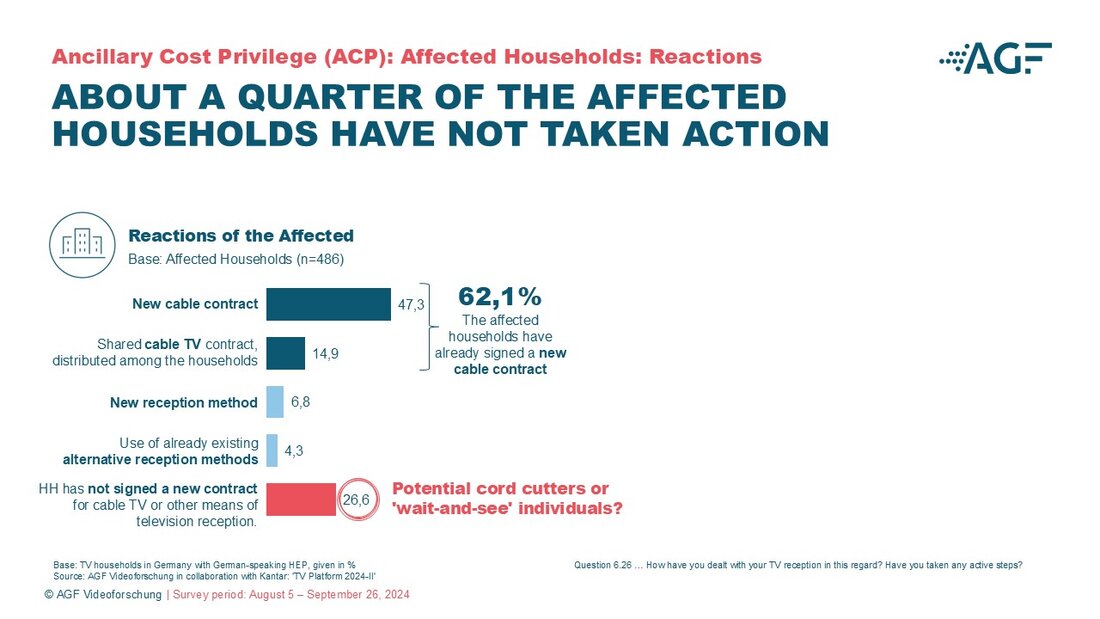

The results of the study show that most rental households have taken action: 68.9 percent of the affected households have taken steps to ensure their TV reception.

- 62.1 percent have signed a new cable contract.

- 6.8 percent of households have switched to alternative reception methods.

- 4.3 percent were already equipped with an additional reception method before the deadline, so no action was required.

Despite overall high activity, a significant proportion of households remain inactive for the time being.

For example, 26.6 percent of the surveyed households affected by the abolition of the ancillary cost privilege do not have a contractual solution for their TV reception at the time of the survey: they have neither signed a new contract for cable TV nor for any alternative reception method. Over half (55.4%) of these households stated that they want to wait and see if TV reception will really be unavailable after the deadline.

"Black screen" largely does not occur

In fact, only 10.3 percent of the affected households report that they have been unable to receive cable TV since the deadline of July 1, 2024. In addition to the 62.1 percent of households that signed a new cable contract, 25.6 percent of households that did not sign a new contract with a cable provider still have cable TV reception. 2.0 percent of respondents did not provide information about their situation.

As a result, the feared "black screen" does not occur in many cases, even though about a quarter of households have not made an active decision.

"The second wave of our platform study shows that many households voluntarily switched to individual contracts, which points to the success of information campaigns. At the same time, however, it becomes clear that the technical and organizational adjustments by the providers are still not complete everywhere. The process clearly still presents challenges, especially with regard to nationwide implementation," explains Kerstin Niederauer-Kopf,CEO of AGF Videoforschung.

Connected TV continues to rise – especially the increase in indirect connections via additional devices

The share of households with a Connected TV has continued to increase. In the second wave of the platform study, 61.4 percent of households reported having an internet-connected TV device (2024-I: 57.6%).

A portion of the increase in CTV is due to the use of additional devices such as streaming sticks or gaming consoles to connect the TV to the internet. 15.4 percent of households now use such devices (2024-I: 11.1%). While direct connections via smart TVs continue to dominate (51.4%), these figures show that streaming sticks and similar devices are becoming increasingly relevant.

Usage patterns: Large screens for video streaming, smartphones for short content

When using streaming services and online video offerings, a correlation between content and device becomes apparent: the big screen remains the preferred choice for content from Netflix (86.3%), Prime Video (86.1%), TV broadcasters' online offerings (80.0%), and Disney+ (79.2%). For short forms, such as short videos on social media platforms (92.5%), YouTube content (75.5%), and videos on news portals (73.9%), most users prefer to use their smartphones.

Methodology

For the Platform Study, which has been conducted on behalf of AGF Videoforschung since 2011, the market research institute Kantar surveys around 2,500 respondents from the German-speaking population aged 14 and older in TV households, in two waves per year. The survey is carried out in the respondents’ homes. The responses to detailed questions concerning sociodemographic background, online and streaming use, TV equipment and receivable programs are validated by an inspection of the type of TV equipment used in the household and the programs that can actually be received. The representative study delivers up-to-date specifications about the potential and distribution of households with a platform and therefore serves as an external specification for structural panel control and for the weighting and extrapolation of platform households. It also provides information about Video-on-Demand use, especially on those services that are not tracked by AGF. The results of the Platform Study are also a key component of AGF’s external specification.