Frankfurt, July 18, 2024. Over half of the affected cable households that have already dealt with the issue want to stay with cable even after the abolition of the utility cost billing privilege. This is the result of the spring wave of the Platform Study 2024-I, conducted twice a year by Kantar on behalf of AGF Videoforschung GmbH.

Since the abolition of the so-called ancillary costs privilege on July 1, 2024, cable fees can no longer be billed as ancillary costs in rental agreements. Of the approximately 17 million households in Germany that have cable reception on at least one TV set, potentially about two-thirds of the households are affected, as they are in rental agreements. In the current platform study, 53.2% of the surveyed cable households in rental agreements stated that their cable fees are billed through operating costs.

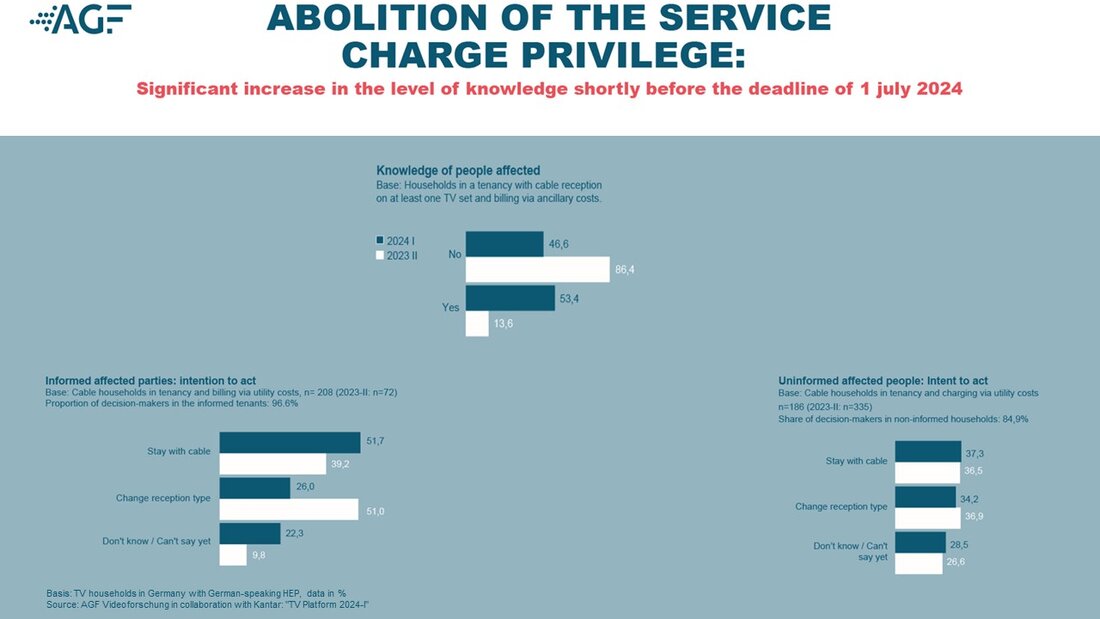

At the time of the data collection, more than half (53.4%) of the affected households had already dealt with the issue or received information about it—a significant increase compared to the last survey wave in autumn 2023 (13.6%). Of these informed respondents, 51.7%—96.6% of whom are co-decision makers regarding the choice of reception mode—want to continue using cable, while 26.0% indicated they want to switch reception methods.

"The ultimate impacts for both cable providers and affected households are not yet fully foreseeable and will continue to be monitored by AGF. According to press reports, providers have already experienced significant customer losses in recent months, and many landlords have canceled their collective contracts by July at the latest," says Kerstin Niederauer-Kopf, CEO of AGF Videoforschung. "It remains to be seen whether and how providers can implement the transition in the short term, as on-site technicians are needed to carry out disconnections. Nevertheless, users must now consider alternatives, as a cable signal will eventually cease, even if everything still seems to be functioning normally at first."

In the survey for the autumn wave of the platform study, the consequences of the abolition of the ancillary costs privilege will play a central role.

Proportion of households with CTV and internet usage reach new highs

The proportion of households with a Connected TV slightly increased to 57.6% (2023-II: 55.5%). The active connection of the TV set to the internet is mostly done via Smart TV (50.7%), and in nearly 7% of households, the TV sets are connected to the internet via additional devices (such as game consoles, streaming sticks, or PCs).

Internet usage (in the last 4 weeks) has risen again to 91.4% (2023-II: 90.6%). Respondents primarily use smartphones (87.7%), followed by PCs/laptops (75.4%), Smart TVs (59.9%), and tablets (41.4%).

Overall, 73.1% of respondents indicated that they had used a video streaming service in the last four weeks. YouTube remains the most popular with 56.0%, followed by Netflix (39.2%), Amazon Prime Video (26.7%), and Disney+ (9.4%). For the first time, the use of videos on social media platforms was specifically surveyed, with 40.5% of respondents using them. Additionally, 38.9% of respondents reported using online offerings from TV broadcasters—an increase compared to previous waves.

Methodological Brief

For the platform study, the market research institute Kantar has been surveying around 2,500 participants from the German-speaking population aged 14 and older in TV households twice a year on behalf of AGF Videoforschung since 2011. The study is conducted in the respondents' households. In addition to a detailed interview on socio-demographics, online and streaming usage, TV equipment, and receivable programs, the information is validated through inspection of the devices and activation of programs. The representative study provides current guidelines on the potential and distribution of households with access to a platform and serves as an external benchmark for structural panel control, as well as for weighting and projection of platform households. It also provides insights into video-on-demand usage, especially of offerings not covered by AGF measurement. The results of the platform study are also a central component of AGF's external benchmark.